African Staffs Reimbursement

Please pay back all borrowed fund before you submit new fund application , or financial dep. will reject that.

According to the requirements of accrual-based financial accounting, to ensure that the actual incurred expenses and expenditures of the company’s departments can be recorded in a timely manner, to improve the accuracy and timeliness of financial data, and to enhance the efficiency of expense reimbursement, it is stipulated as follows for the expenses that have been incurred without reimbursement/payment in 2023:

1. Current expenses do not cross years and expenses incurred in the same month do not cross months. For expenses incurred in each month, the parties concerned shall, at the latest, after the expenses are actually incurred or after the corresponding invoices are obtained, submit the documents and apply for reimbursement in accordance with the financial requirements by the end of the next month.

2. For expenses incurred in 2023 and not yet applied for, it is required to submit the documents before December 25, 2023 at the latest. If the documents have not been submitted under special circumstances, they should be submitted to the Finance Office before 6:00 p.m. on Thursday, December 28, 2023 for reimbursement, submitted to the Finance Department by 6:00 p.m. for expense withholding by the Finance Department. (FY 2023 reimbursements that have been submitted with an Inventory must be reimbursed in January 2024.) No reimbursement will be made after the unexcused late date.

3. The documents are: “Payment Request Form”, “General Expense Reimbursement Form”, “Travel Expense Reimbursement Form”.

4. The submission of content: unaudited expenses are required to be listed (including OA has been submitted but paper documents have not been submitted or paper has been submitted but the OA process has not been to the financial node)

5. The way of submission: the regional assistant collect all the forms according to the cost accounting company, summarized and sent to my email.

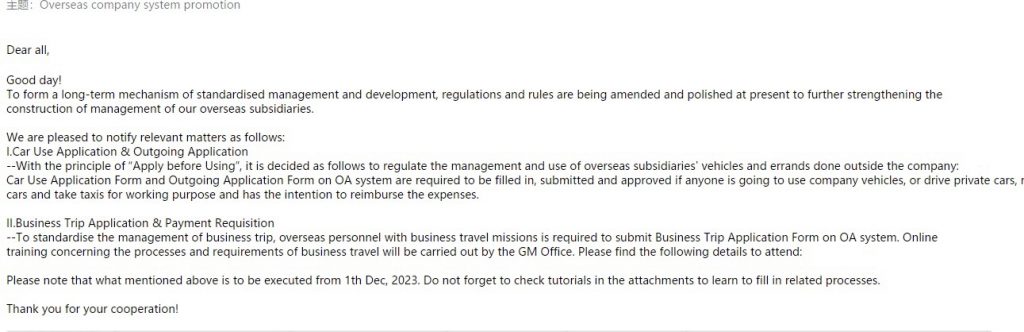

If you will have business trip, please don’t forget to submit the business trip application on OA system, or in near future, your reimbursement can’t be handled. Furhtermore, during the business trip, for any high expense that may not be reasonable, please report to manager in advance in case these reimbursement can’t be handled.

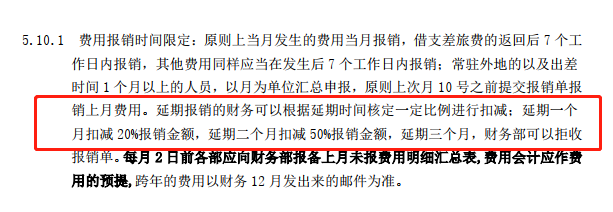

Attention, Please! Account dep. has posted new reimbursement rule, for delayed reimbursement, please complete them before end of Aug. Or your reimbursement will be deduced. Here attached specifical rule.

Reimbursement time limit: In principle, the expenses incurred in the current month will be reimbursed within the current month, and the borrowed travel expenses will be reimbursed within 7 working days after the return, and other expenses should also be reimbursed within 7 working days after the occurrence; Stationed overseas staffs and staffs for business trips more than 1 month should submit a summary report on a monthly basis. In principle, the reimbursement form should be submitted before the 10th of the next month for reimbursement of the expenses of the previous month. The financial deferred reimbursement can be deducted according to a certain percentage approved by the postponement time: 20% of the reimbursement amount will be deducted for one month’s delay, 50% of the reimbursement amount will be deducted for two months’ delay, and the financial department can reject the reimbursement form for three months’ delay. Before the 2nd of each month, each department shall report to the Finance Department a detailed summary of the unreported expenses of the previous month, and the expense accountant shall make the accrual of expenses.

费用报销时间限定:原则上当月发生的费用当月报销,借支差旅费的返回后7个工作日内报销,其他费用同样应当在发生后的7个工作日内报销;常驻外地的以及出差时间1个月以上的人员,以月为单位汇总申报,原则上次月10号之前提交报销单报销上月费用。延期报销的财务可以根据延期时间核定一定比例进行扣减:延期一个月扣减20%报销金额,延期二个月扣减50%报销金额,延期三个月,财务部可以拒收报销单。每月2日前各部应向财务部报备上月未报费用明细汇总表,费用会计应作费用的预提。

1.African reimbursement Stardard

| African Countries | Accomodation | Food subsidy | |

| Diego Garcia (US), Mauritius, Mayotte (French), Morocco, Namibia, Pantelleria (Italian), Reunion (French), Saint Helena, Ascension and Tristan da Cunha (British), Seychelles, Socotra Islands (also), Tunisia | 100 USD per day | 20 USD per day | |

| Botswana, Cape Verde, Egypt, Kenya, Lesotho, Swaziland, Zimbabwe, Republic of South Africa | 110 USD per day | 20 USD per day | |

| Algeria, Angola, Benin, Burkina Faso, Burundi, Cameroon, Central African Republic, Chad (Chad), Comoros, Côte d’Ivoire, Democratic Republic of the Congo, Djibouti, Equatorial Guinea, Eritrea, Ethiopia, Gabon, The Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Libya, Madagascar, Malawi, Mali, Mauritania, Mozambique, Niger, Nigeria, Republic of Congo, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, Somalia, Somaliland, South Sudan, Sudan, Tanzania, Togo, Uganda, Western Sahara (Saharan Arab Democratic Republic), Zambia | 130 USD per day | 20 USD per day |

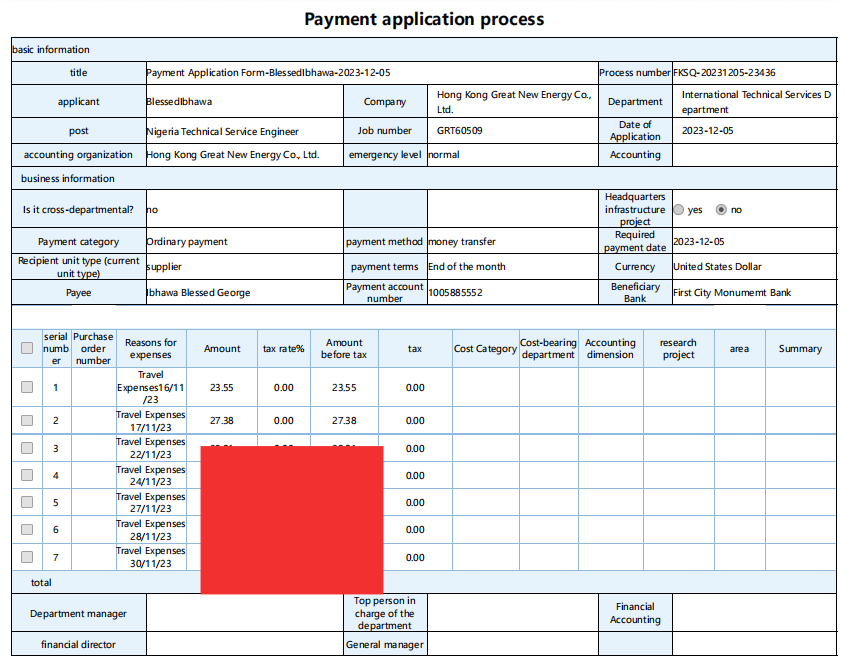

2. reimbursement Form

Please claim Traveling place, purpose, client names and other explanations clearly and use local currency for your reimbursement.

3.Prepare all invoices for your reimbursement

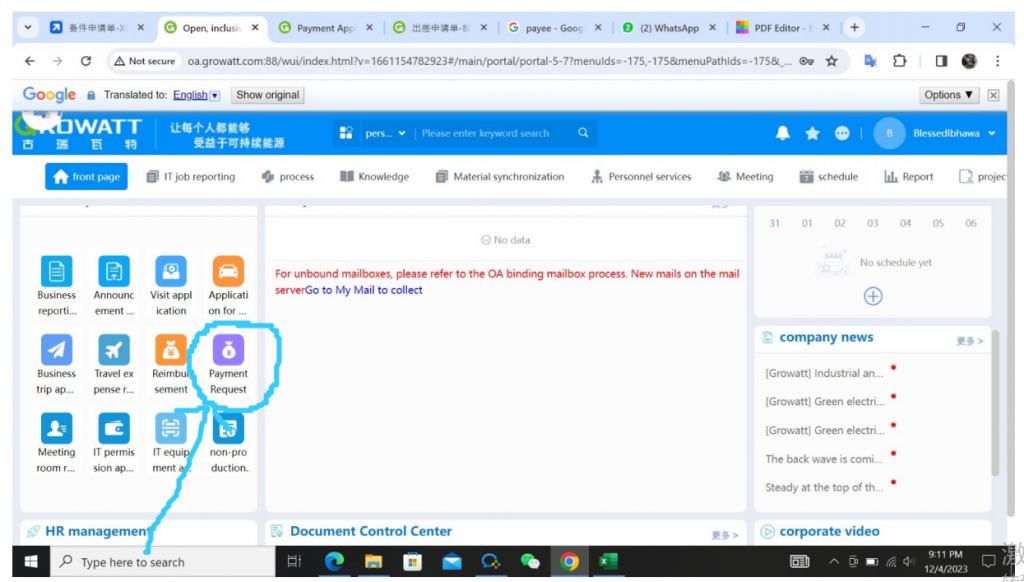

4. submit reimbursement application on oA System

a. Access OA System

http://oa.growatt.com:88/wui/index.html?v=1661154782923#/?_key=zm2j80

b. Select icon below

c. Fill in Payment Application Process